Sixty-three small businesses awarded $1.1 million in loans in Kalamazoo

COVID-closed businesses get financial help through Kalamazoo Small Business Loan Fund to ease the impact of a month without revenue.

Invoices seeking payment for car parts, tools, and other operational purchases arrive from the 25th to the 27th of each month at CARSTAR Kalamazoo.

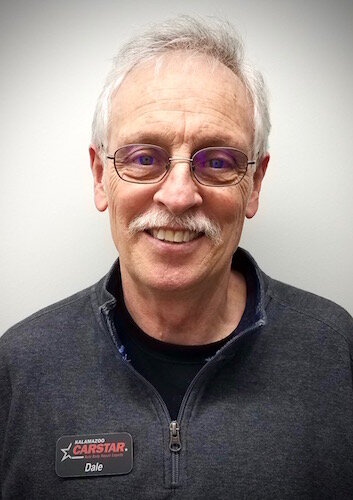

At any given time, the automobile collision repair shop at 522 E. Walnut St. is paying for goods it received and used last month. That has made April an anxious month for franchise owner Dale DeGroot.

In keeping with the statewide effort to limit the spread of the coronavirus by having all but life-essential businesses close down, DeGroot says, “We were closed all of April.”

Announcements in recent days by the City of Kalamazoo and the United Way of the Battle Creek and Kalamazoo Region should make May a bit less anxious for him. DeGroot’s CARSTAR franchise is among 63 small businesses in Kalamazoo set to receive loans through the Kalamazoo Small Business Loan Fund, a fund created earlier this month through a partnership between the City of Kalamazoo and the United Way.

The fund has announced awards of low-interest loans totaling $1.1 million to Kalamazoo businesses with fewer than 50 workers and less than $2.5 million in annual revenues. To be eligible, applicant businesses had to: be impacted by statewide orders that require workers to stay at home unless they perform life-sustaining work; have intentions to support impacted workers; and be able to demonstrate an income loss due to the coronavirus (COVID-19) outbreak.

“It definitely helps out,” DeGroot says of the loan his business will receive. “Our production was shut down for four weeks basically – for all of April. We had the office open for communication with insurance companies (who refer about 90 percent of the shop’s customers), and some people came in for estimates. But we didn’t fix any cars for the month of April.”

CARSTAR has been awarded a $20,000 loan which DeGroot says will be used to pay down its previous-month invoices.

“Small businesses are both the economic lifeblood of our community and the first to feel the negative effects of the pandemic,” says Chris Sargent, president and chief executive officer of the United Way of the Battle Creek and Kalamazoo Region, which is managing the fund.

In a press release, he said, the local loans are helping small businesses “bridge the gap until state and federal aid is available.” And he said, “Businesses receiving loans are able to keep paying lower-income workers who can’t endure a lengthy job loss or furlough.” The fund is also helping many women- and minority-owned businesses stay afloat during this time, he said.

“People see this as a lifeline,” says Steve Brown, Foundation for Excellence manager for the City of Kalamazoo.

The Kalamazoo Small Business Loan Fund was established with a $2 million grant from the Foundation For Excellence. It was designed by the city and the United Way based on national best practice models and with assistance from the W.E. Upjohn Institute for Employment Research, the Kalamazoo Downtown Partnership, and the Michigan Small Business Development Center.

Loan requests were required to range from $5,000 to $50,000. And awards were intended to complement other relief programs available to community members, including the United Way’s Disaster Relief Fund and the Kalamazoo Community Foundation Urgent Relief Fund. Brown says the average loan, thus far, has been about $14,000.

“These are very confusing and stressful times and people need to know where they can turn,” Brown says. “With state and federal programs, that’s not always clear.”

At the national level, controversy has arisen about large businesses receiving the bulk of money initially made available through a special U.S. Small Business Administration fund. Brown says Kalamazoo Small Business Loans are intended to be high access-low barrier opportunities for financial help.

The term of each loan is 36 months, with no interest or payments during the first six months, and 1 percent annual interest applied over the remaining 30 months.

“There’s a lot of smart people working hard at the state and federal level to offer help,” Brown says. “We’re at the city level and we love our city and we want to take care of our city. This was an opportunity for us to be fast and responsive, and it looks like we have been.”

DeGroot recently learned his business will receive an $86,000 loan through the Small Business Administration’s Paycheck Protection Program. That loan does not have to be repaid if he can demonstrate that at least 75 percent of it was used for payroll or related expenses. He said he will use that money to put his staff back to work after a month-long hiatus, covering payroll costs for the next two months.

At the end of that period, he says, “Hopefully we’re close to back to normal – back to normal scheduling and with work coming in.”

Reacting to statewide efforts to limit the spread of the coronavirus, DeGroot closed his business on March 30. As a car repair shop, Carstar was allowed to remain open. However, DeGroot says health concerns of some of his 10-person staff, the average age of the staff (most are over 40), and the potential of them spreading sickness to susceptible family members, created too great a risk.

“The last full week of March, we still had jobs in the shop,” DeGroot says. “But we finished everything by the 27th and closed on the 30th.”

The 63 businesses to receive Kalamazoo Small Business Fund loans included:

• Restaurants such as Martini’s Pizza, Rustica, Green Door Distilling Co., and The Crew Family Restaurant and Bakery;

• Retailers such as Bookbug, Earthly Delights, Rentalex of Michigan, and Rocket Fizz.

• And services such as Kalamazoo Psychology, B&W Charters, Southwest Foot and Ankle Specialists, and Global Cleaning Pros.

Among the loans:

• 30 percent went to businesses in the service industry, 27.7 percent were in the food and beverage industry, 15.7 percent were in retailing, and 3.6 percent were in manufacturing.

• 42.6 percent were owned by women, 46.8 percent were owned by men and 10.6 percent were owned by individuals who preferred not to respond to that question.

•14.9 percent were minority-owned (although another 14.9 percent of all applicants preferred not to answer that question.)

“The loan will allow me to keep my doors open,” says Clarence Gardner, owner of C’s Perfect Tie & Accessories at 117 W. South St.

In a City of Kalamazoo press release, he says that until the coronavirus, his 20-year-old business has never needed a loan to stay open. He thanked the community, the United Way, the city, and the Foundation For Excellence for their support, saying, “I look forward to continuing to serve this great community.”

DeGroot says things will be tough for his business until more people get back to work in general. With Michiganders asked to stay home to prevent the spread of the respiratory disease, fewer motorists are on the roads, there are fewer collisions, and that means less work for his people.

“We’ll have to play it by ear,” he says. “Hopefully, we’ll keep enough work coming in to keep them all in business.”

His shop employs six technicians.

“I’ve been doing this work for over 50 years and it’s the first time I’ve had anything like this,” DeGroot says of the impact the coronavirus has had on business. Headed into the future, he says “We’ll put faith in the Lord to guide us through it and we’ll see what happens on the other end.”